The RVAR Purchase Agreement

Jan 29, 2025

In Virginia, the process of making an offer on a residential property differs from many other states. Instead of submitting a separate written offer, buyers use a comprehensive document known as a Purchase Agreement. This agreement outlines the detailed terms of the offer and is presented directly to the sellers. If the sellers accept these terms, the agreement is ratified, and preparations for closing begin. However, if the sellers do not agree, both parties engage in negotiations to modify the terms until a mutually acceptable agreement is reached. This final, signed version of the Purchase Agreement is then forwarded to the closing attorneys to finalize the sale.

Let’s look through a purchase agreement together!

The very top of the purchase agreement defines who is involved in the purchase. It defines both the Seller and the Buyer by their legal names and what’s listed on public records.

Paragraph 1

Paragraph 1 defines the property very specifically, using what’s called a legal description. Your agent will get these off of public records to make it very clear what property you are purchasing.

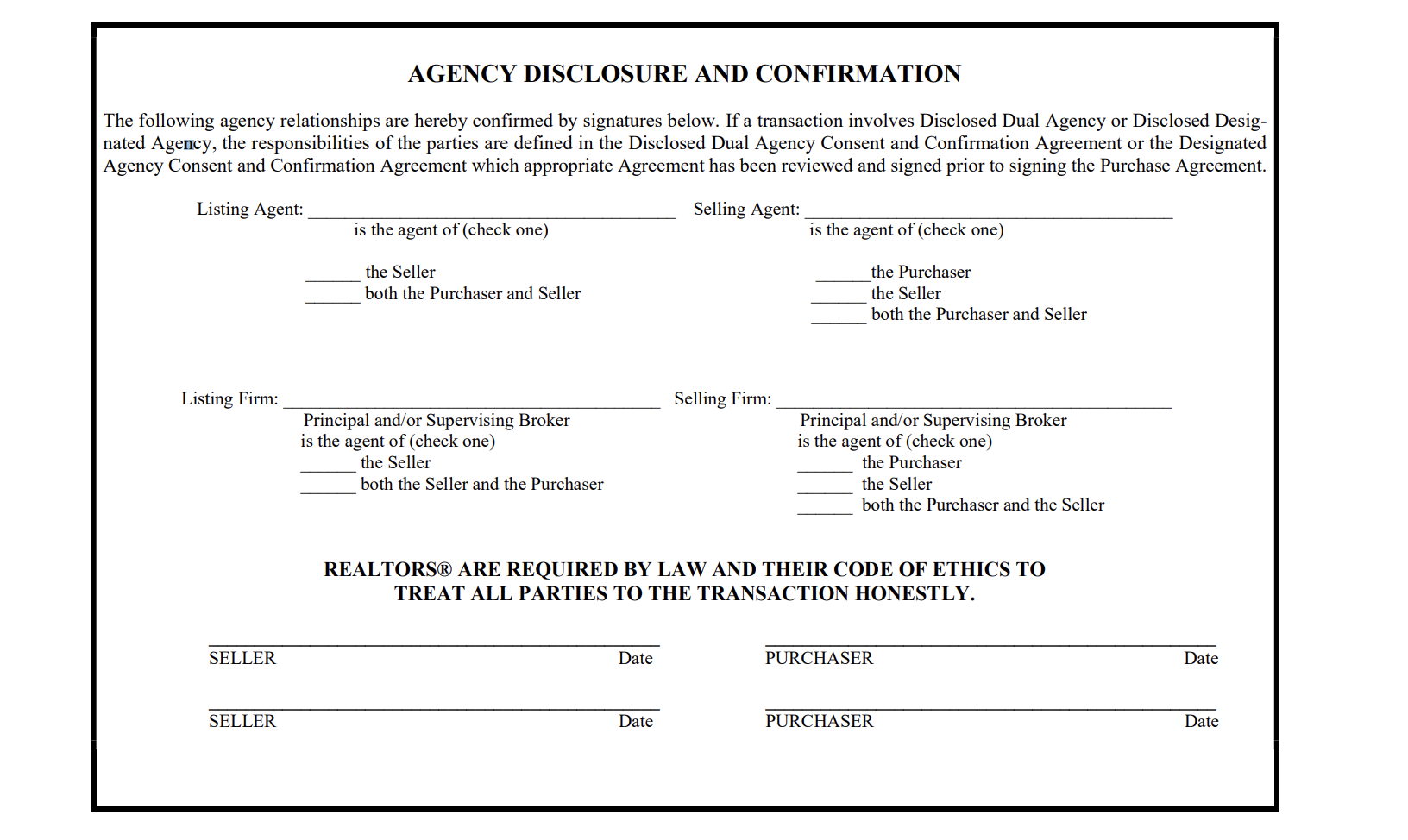

This section clearly defines the relationships between the agents involved and the Buyer and Seller. The agents are listed above and who they are representing is checked beneath their name. The Seller and Buyer will then sign their names at the bottom.

Paragraph 2

This section lists the additional documents (addenda) and required disclosures that are part of the real estate contract, ensuring all relevant terms and property information are acknowledged. It helps both parties confirm any special conditions (like lake-related rules or dual agency) and required disclosures (such as lead paint risks or property defects) are included and signed off.

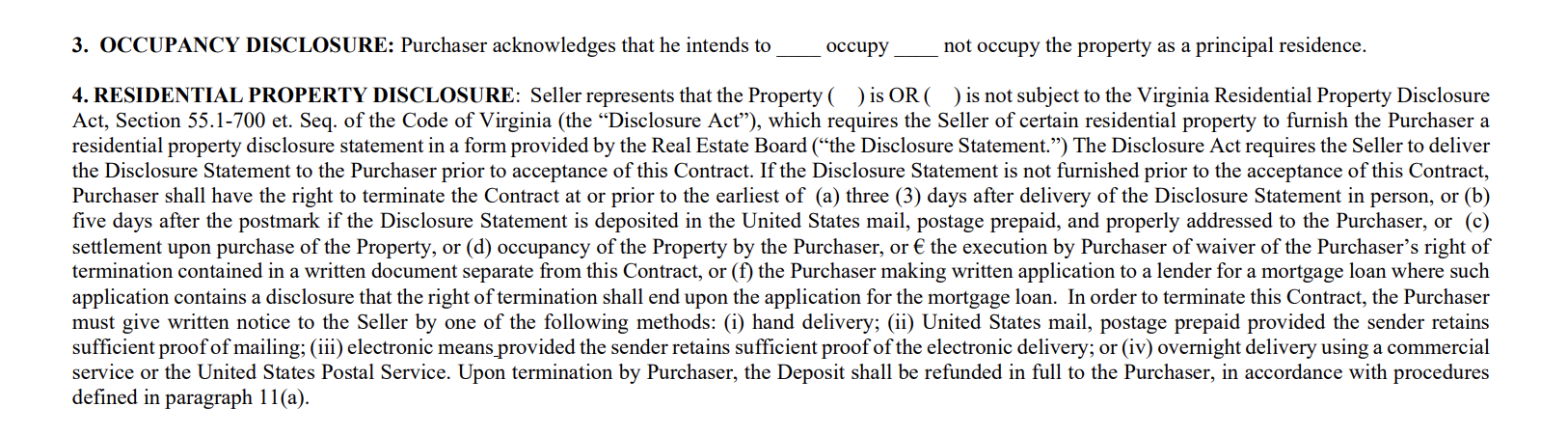

Paragraph 3 & 4

Paragraph 3 simply states whether or not this property is intended as your primary (principal) residence once you purchase.

Paragraph 4, simply put, says that if the property requires a disclosure, the seller must give it to the buyer before the contract is accepted. The Residential Property Disclosure is almost always presented to the buyer before they put in an offer.

Paragraph 5

This section explains that if the property is part of a Common Interest Community (CIC), such as an HOA or condominium, the seller must provide a resale certificate or notify the buyer if it’s unavailable. If the certificate isn’t provided within 14 days or as required, the buyer has the right to cancel the contract within 3 days or another specified period without penalty and receive a refund of their deposit. However, if the buyer doesn't exercise this right before settlement, it is waived.

Paragraph 6

Paragraph 6 states clarifies that any property built before Jan 1,1978 will need a Lead-Based Paint Disclosure to be signed by the Buyer and Seller.

Paragraph 7

Section 7 explains that under Virginia law, contractors or suppliers who provide labor or materials worth $50 or more can place a mechanic's lien on the property if they are not paid, even after settlement. The seller must provide an affidavit at closing, confirming that no unpaid labor or materials exist that could result in such a lien. If any work was done, the seller must also provide proof that all related costs have been paid to avoid potential liens against the property. Your title company will help make sure this is taken care of before closing.

Paragraph 8 & 9

The Fair Housing Disclosure ensures that all offers are treated equally, without discrimination based on factors like race, religion, gender, disability, sexual orientation, veteran status, or any other protected category under U.S., Virginia, and local laws, as well as the REALTOR® Code of Ethics.

The Megan’s Law Disclosure advises buyers to conduct their own research on registered sex offenders in the area by contacting local police or the Virginia State Police, as the seller and agents are not responsible for providing this information.

Paragraph 10

Section 10 states that fixtures like built-in appliances, window coverings, carpeting, light fixtures, alarms, garage door openers, smart home devices, and landscaping are included in the sale unless noted otherwise. Any listed personal property is included for convenience but holds no added value.

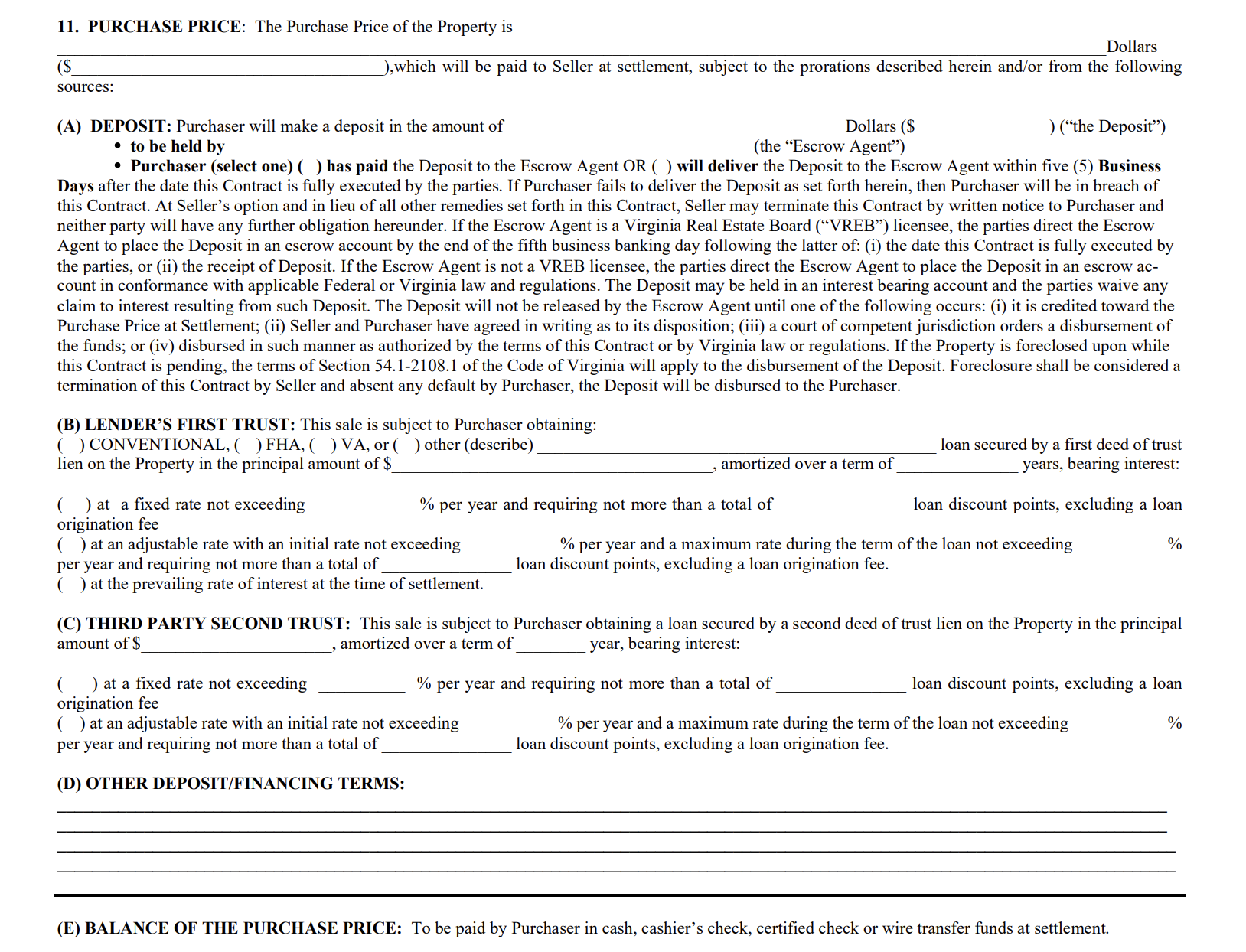

Paragraph 11

This section outlines the financial details, starting with the earnest money deposit, which shows the buyer’s commitment. The deposit is held by an escrow agent and applied toward the purchase at closing. If the buyer doesn’t pay it on time, the seller can cancel the contract. The deposit stays in escrow unless used at closing, both parties agree on its release, or a court orders it. If foreclosure happens before closing, the buyer gets the deposit back unless they’re at fault.

Next, the first mortgage loan details how the buyer will finance the home, whether through a conventional, FHA, VA, or another type of loan. The buyer must specify if the interest rate will be fixed, adjustable, or based on market rates at closing. If a second mortgage loan is needed, this section outlines its terms, including repayment and interest rate details.

The contract also allows for other financing terms, covering any additional agreements between the buyer and lender. Finally, the balance of the purchase price must be paid at closing, after deducting deposits and loans. This final payment must be made via cash, cashier’s check, certified check, or wire transfer—personal checks aren’t accepted.

Paragraph 12 & 13